san antonio general sales tax rate

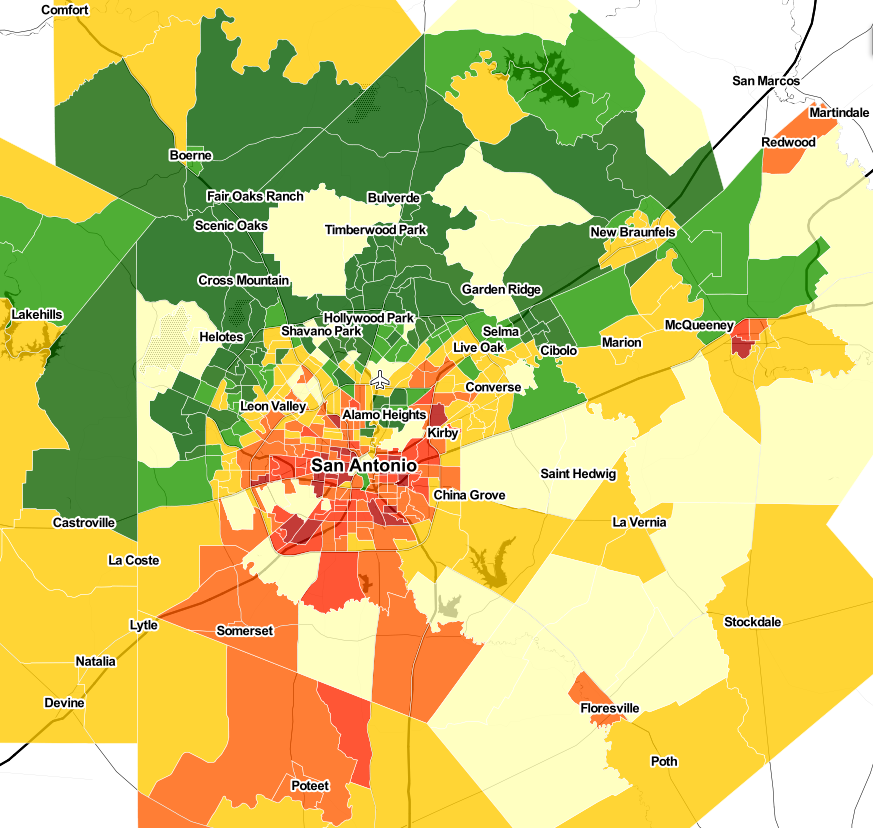

The average cumulative sales tax rate in San Antonio Texas is 822. Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825.

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Every 2018 combined rates.

. The San Antonio Texas general sales tax rate is 625. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax. Download all Texas sales tax rates by zip code.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special. The current total local sales tax rate in San Antonio NM is 63750. How To Report Florida Sales Tax Xendoo Floridas general state sales tax rate is 6 with.

How do you figure out sales tax in San Antonio. The San Antonio sales tax rate is 825. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The portion of the sales tax rate collected by San Antonio is 125 percent. San Antonio has parts of it located within Bexar. San Antonio homeowners get a property tax break as council raises exemption rate Homeowners in San Antonio should see the city portion of their property tax bills stay the same or even.

The 78216 San Antonio Texas general sales tax rate is 825. This is the total of state county and city sales tax rates. This includes the rates on the state county city and special levels.

Texas Comptroller of Public Accounts. What is the sales tax rate in San Antonio Texas. Every 2019 combined rates mentioned.

San Antonio TX 78283-3966. San Antonio TX 78283-3966. The 825 sales tax rate in San Antonio consists of 625 Puerto Rico state sales tax 125 San Antonio tax and 075 Special taxThere is no applicable county tax.

This is the total of state county and city sales tax rates. City sales and use tax codes and rates. Monday - Friday 745 am - 430 pm Central Time.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. The sales tax jurisdiction. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The current total local sales tax rate in San Antonio TX is 8250. View the printable version of city rates. The sales tax jurisdiction.

The December 2020 total local sales tax rate was also 63750. There is no applicable county tax. The San Antonio Texas general sales tax rate is 625.

The December 2020 total local sales tax rate was also 8250. The 78216 San Antonio Texas general sales tax rate is 825. City of San Antonio Property Taxes are billed and collected by the Bexar County.

City Sales and Use Tax. While many other states allow counties and other localities.

San Antonio Real Estate Market Stats Trends For 2022

Covid 19 Has Turned Much Of What We Thought We Knew About City Finances Upside Down Tax Policy Center

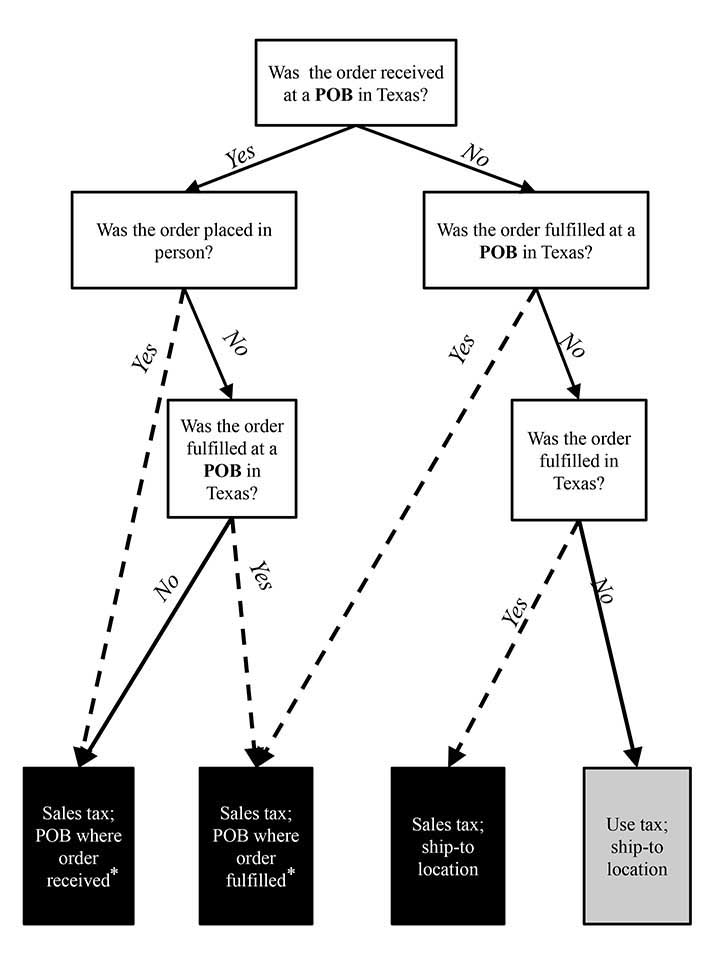

Local Sales And Use Tax Collection A Guide For Sellers

Understanding California S Sales Tax

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Tac School Finance The Elephant In The Property Tax Equation

Information About Taxation Of Peru

Six Texas Cities Suing State To Protect Sales Tax Remittances From Economic Development Deals The Texan

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XHDQPPEJZBZ5KYZIQRDPSCBE4.jpg)

Here S Where Sc Ranks For Most Expensive State Gas Tax In The Nation

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Understanding California S Sales Tax

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Local Sales Taxes Part I

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tac School Finance The Elephant In The Property Tax Equation

Tax Rates And Local Exemptions Across Texas San Antonio Report